For single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and for heads of households, the standard deduction will be $18,650 for tax year 2020, up $300. The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year.

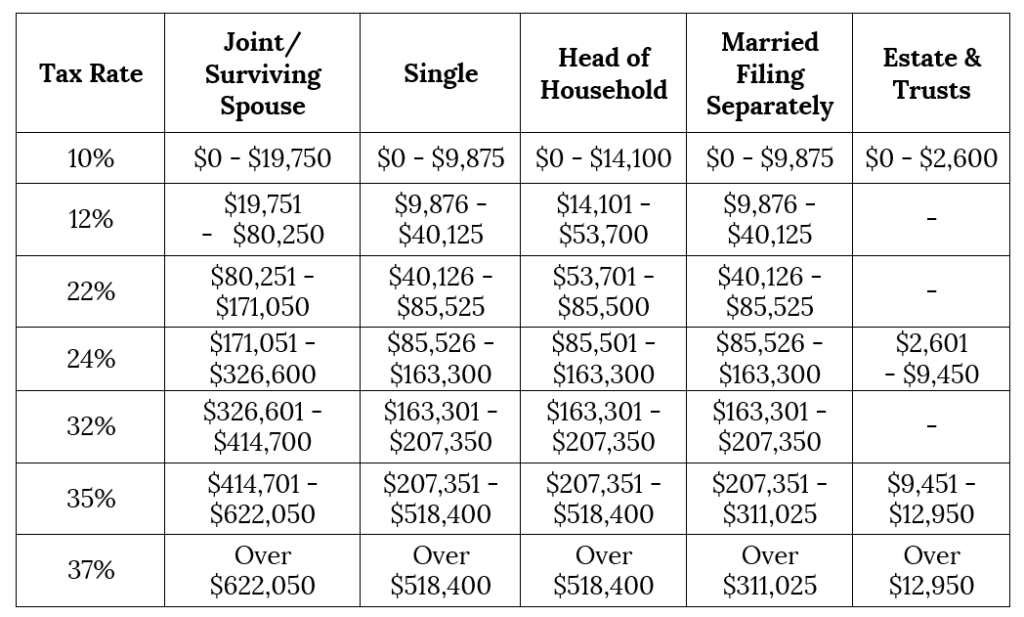

The tax items for tax year 2020 of greatest interest to most taxpayers include the following dollar amounts: The tax year 2020 adjustments generally are used on tax returns filed in 2021. The new penalty will be adjusted for inflation beginning with tax year 2021. The tax law change covered in the revenue procedure was added by the Taxpayer First Act of 2019, which increased the failure to file penalty to $330 for returns due after the end of 2019.

#Federal single tax brackets 2021 pdf

Revenue Procedure 2019-44 PDF provides details about these annual adjustments. WASHINGTON - The Internal Revenue Service today announced the tax year 2020 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. The Setting Every Community Up for Retirement Enhancement Act, better known as the SECURE Act, was passed at the end of 2019 and increased the minimum penalty for failure to file from $330 to $435.

0 kommentar(er)

0 kommentar(er)